Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 4P

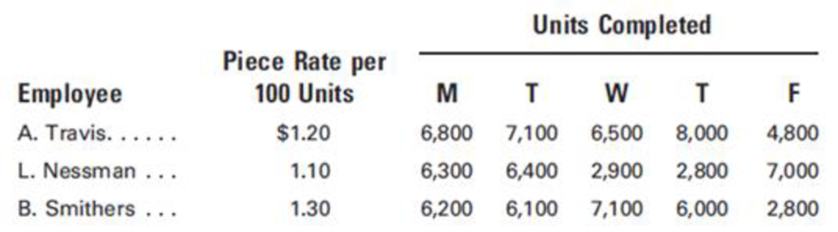

Payroll for piece-rate wage system

Collier Manufacturing Co. operates on a modified wage plan. During one week’s operation, the following direct labor costs were incurred:

The employees are machine operators. Piece rates vary with the kind of product being produced. A minimum of $70 per day is guaranteed to each employee by union contract.

Required:

- 1. Compute the weekly earnings for Travis, Nessman, and Smithers.

- 2. Prepare

journal entries to:- a. record the week’s payroll, assuming that none of the employees has achieved the maximum base wage for FICA taxes. The income tax withheld for each employee amounts to 10% of gross wages.

- b. record payment of the payroll.

- c. record the employer’s share of payroll taxes, assuming that none of the employees has achieved the maximum base wage for FICA or

unemployment taxes.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Jon Stone is paid $20 an hour for an 8-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular

employment is on the basis of 40 hours a week, 5 days a week. Overtime premium is charged to Factory Overhead.

Required:

Using the labor-time record below:

a.

Compute Jerrod's total earnings for the week.

b.

Present the journal entry to distribute Jerrod's total earnings.

Sunday

Monday

Tuesday

Wednesday

Thursday

Friday

Saturday

ТОTAL

Job F2

3

5

4

31

Job M1

1

3

6

14

Admin

1

3

6

TOTAL

8.

8.

8

10

51

odified wage plan Marcellus Wallace earns $25 per hour for up to 400 units of production per day. If he produces more than 400 units per day, he will receive an additional piece rate of $0.50 per unit. Assume that his hours worked and pieces finished for the week just ended were as follows: a. Determine Wallace’s earnings for each day and for the week. b. Prepare the journal entry to distribute the payroll, assuming that any make-up guarantees are charged to Factory Overhead.

Oh no! Our expert couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Here's what the expert had to say:

Hi and thanks for your question! Unfortunately it looks incomplete. Please resubmit the question with pieces finished and hours worked information. We've credited a question back to your account. Apologies for the inconvenience.

Ask Your Question Again

8 of 10 questions left

until 4/18/21…

Ronald Factory provides for an incentives scheme for its factory workers which features a combined minimum guaranteed wage of 875 per week and a piece rate of 11.25. Production report for the week show.

Employee Units Produced

R 67

O 78

L 80

A 82

N 72

D 75

The portion of the weekly payroll that should be charged to factory overhead is?

Chapter 3 Solutions

Principles of Cost Accounting

Ch. 3 - What is the difference between direct and indirect...Ch. 3 - Prob. 2QCh. 3 - Prob. 3QCh. 3 - In production work teams, output is dependent upon...Ch. 3 - Define productivity.Ch. 3 - Prob. 6QCh. 3 - Prob. 7QCh. 3 - Prob. 8QCh. 3 - Prob. 9QCh. 3 - What are the sources for posting direct labor cost...

Ch. 3 - What are the sources for posting indirect labor...Ch. 3 - In accounting for labor costs, what is the...Ch. 3 - Prob. 13QCh. 3 - Prob. 14QCh. 3 - Besides FICA, FUTA and state unemployment taxes,...Ch. 3 - Prob. 16QCh. 3 - Prob. 17QCh. 3 - Prob. 18QCh. 3 - What is a shift premium, and how is it usually...Ch. 3 - Prob. 20QCh. 3 - Prob. 21QCh. 3 - Prob. 22QCh. 3 - Prob. 23QCh. 3 - Prob. 24QCh. 3 - Prob. 25QCh. 3 - R. Herbert of Crestview Manufacturing Co. is paid...Ch. 3 - Recording payroll Using the earnings data...Ch. 3 - Prob. 3ECh. 3 - Peggy Nolan earns 20 per hour for up to 300 units...Ch. 3 - Overtime Allocation Arlin Fabrication Company...Ch. 3 - Prob. 6ECh. 3 - Davis, Inc. paid wages to its employees during the...Ch. 3 - Recording the payroll and payroll taxes Using the...Ch. 3 - Prob. 9ECh. 3 - The total wages and salaries earned by all...Ch. 3 - The total wages and salaries earned by all...Ch. 3 - A weekly payroll summary made from labor time...Ch. 3 - Prob. 13ECh. 3 - Accounting for bonus and vacation pay Cathy Muench...Ch. 3 - Prob. 15ECh. 3 - Prob. 16ECh. 3 - Payroll computation with incentive bonus Fifteen...Ch. 3 - Prob. 2PCh. 3 - Prob. 3PCh. 3 - Payroll for piece-rate wage system Collier...Ch. 3 - A rush order was accepted by Bartley's Conversions...Ch. 3 - The following form is used by Matsuto...Ch. 3 - Payment and distribution of payroll The general...Ch. 3 - Prob. 8PCh. 3 - An analysis of the payroll for the month of...Ch. 3 - Prob. 10PCh. 3 - Prob. 11PCh. 3 - Prob. 12PCh. 3 - Prob. 13PCh. 3 - Using the information in P3-13, prepare the...Ch. 3 - Pan-Am Manufacturing Co. prepares cost estimates...Ch. 3 - Incentive wage plan David Kelley is considering...Ch. 3 - Huron Manufacturing Co. uses a job order cost...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- R. Herbert of Crestview Manufacturing Co. is paid at the rate of 20 an hour for an eight-hour day, with time-and-a-half for overtime and double-time for Sundays and holidays. Regular employment is on the basis of 40 hours a week, five days a week. At the end of a week, the labor time record shows the following: Because jobs are randomly scheduled for the overtime period, any overtime premium is charged to Factory Overhead. a. Compute Herberts total earnings for the week. b. Present the journal entry to distribute Herberts total earnings. (Note: These single journal entries here and in E3-2, E3-3, E3-4, E3-8 and E3-9 are for the purpose of illustrating the principle involved. Normally, the entries would be made for the total factory payroll plus the administrative and sales payroll.)arrow_forwardPrepare the journal entry to record the factory wages of $28,000 incurred for a single production department assuming payment will be made in the next pay period.arrow_forwardMax's Enterprise operates using the Rowan Bonus Scheme. From its production work during the week ending April 24th, an employee whose basic hourly rate of pay is $14 was assigned the following job which the employee completed. Time taken Job# Time allowed 10 7 hours 45 minutes 6 hours 15 minutes What is the employee's basic pay if the Rowan Bonus Scheme was used? Select one: O A. $75 O B. $84 O C. $87.50 OD. $62.50arrow_forward

- The accountant for Barry Ltd compares each month's actual results with a monthly plan. The standard direct labour rates and the standard hours allowed, given the actual output in April, are shown in the following schedule: Standard direct labour rate per hour Labour class III Labour class II Labour class I Standard direct labour hours allowed, given April output 1,000 1,000 1,000 $26.00 $22.00 $12.00 A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for April were as follows. Actual direct labour rate per hour Actual direct labour hours Labour class II $28.00 1,100 Labour class II $23.00 1,300 Labour class I $14.00 750 Required: a) Calculate the following variances for April, indicating whether each is favourable or unfavourable: i direct labour rate variance for each labour class. ii direct labour efficiency variance for each labour class. b)…arrow_forwardThe following is the basic payroll date for week 2 of department X of Arshad manufacturing. Arshad manufacturing limited operates a badge costing system .overtime is paid at a time and a half overtimes is used as a means or increasing the output however 20% of the overtime for direct and indirect workers was incurred at the specific request of a customers who required an order to be completed quickly. Assignment / Class activity Department XYZ Direct Worker Indirect workers Basic Rate per hour 1.8 currency 1.2 Total attendance time 960 hours 420 overtime worked 120 hours 48 Shift premium 180 60 group bonus 192 84 Employers EPF contributions 150 66 Employees decustions - Income tax 300 120 EPF 90 42 A breakdown of the direct workers times from returned work shown…arrow_forwardThe accountant for Barry Ltd compares each month’s actual results with a monthly plan. The standard direct labour rates and the standard hours allowed, given the actual output in April, are shown in the following schedule: Standard direct labour rate per hour Standard direct labour hours allowed, given April output Labour class III $26.00 1,000 Labour class II $22.00 1,000 Labour class I $12.00 1,000 A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for April were as follows. Actual direct labour rate per hour Actual direct labour hours Labour class III $28.00 1,100 Labour class II $23.00 1,300 Labour class I $14.00 750 Required: Calculate the following variances for April, indicating whether each is…arrow_forward

- Journal Entries, T-Accounts Lincoln Brothers Company makes jobs to customer order. During the month of May, the following occurred: a. Materials were purchased on account for $45,760. b. Materials totaling $40,880 were requisitioned for use in producing various jobs. c. Direct labor payroll for the month was $19,200 with an average wage of $12 per hour. d. Actual overhead of $8,860 was incurred and paid in cash. e. Manufacturing overhead is charged to production at the rate of $5.40 per direct labor hour. f. Completed jobs costing $59,000 were transferred to Finished Goods. g. Jobs costing $58,000 were sold on account for $ 73,850. Make the entry to record the revenue from the sale first, followed by the entry to record the cost of the jobs. Beginning balances as of May 1 were: Materials Inventory Work-in-Process Inventory Finished Goods Inventory Required: $1,300 3,400 2,640 1 more notification 1. Prepare the journal entries for the preceding events.arrow_forwardPrepare the journal entry to record the factory wages of $14,000 incurred for a single production department assuming payment will be made in the next pay period. If an amount box does not require an entry, leave it blank. Work in Process Wages Payable X Xarrow_forwardQ) The accountant for Barry ltd compares each month's actual results with a monthly plan. The standard direct labour rates and the standard hours allowed, given the actual output in April, are shown in the following schedule: Standard direct labour rate per hour Standard direct labour hours allowed, given April output Labour class III $26 1,000 Labour class II $22 1,000 Labour class I $12 1,000 A new union contract negotiated in March resulted in actual wage rates that differed from the standard rates. The actual direct labour hours worked and the actual direct labour rates per hour for April were as follows. Actual direct labour rate per hour Actual direct labour hours Labour class III $28 1,100 Labour class II $23 1,300 Labour class I $14 750 Required: (a) Calculate the following variances for April, indicating whether each is favourable or unfavourable: (i) direct labour rate variance for each labour class. (ii) direct labour efficiency variance for…arrow_forward

- Prepare the journal entry to record the factory wages of $25,000 incurred in the processing department and $15,000 incurred in the production department assuming payment will be made in the next pay period.arrow_forwardThe total wages and salaries earned by all employees of Langen Electronics, Ltd. during March, as shown in the labor cost summary and the schedule of fixed administrative and sales salaries, are classified as follows: a. Prepare a journal entry to distribute the wages earned during March. b. What is the total amount of payroll taxes that will be imposed on the employer for the payroll, assuming that two administrative employees with combined earnings this period of 3,000 have exceeded 8,000 in earnings prior to the period?arrow_forwardKyle Forman worked 47 hours during the week for Erickson Company at two different jobs. His pay rate was 14.00 for the first 40 hours, and his pay rate was 11.80 for the other 7 hours. Determine his gross pay for that week if the company uses the one-half average rate method. a. Gross pay__________ b. If prior agreement existed that overtime would be paid at the rate for the job performed after the 40th hour, the gross pay would be________arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Step 5: Base Pay Structure; Author: GreggU;https://www.youtube.com/watch?v=CnBsWsY6O7k;License: Standard Youtube License