You place an order for 470 units of inventory at a unit price of $175. The supplier offers terms of 2/15, net 90. a-1. How long do you have to pay before the account is overdue? a-2. If you take the full period, how much should you remit? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b-1. What is the discount being offered?

You place an order for 470 units of inventory at a unit price of $175. The supplier offers terms of 2/15, net 90. a-1. How long do you have to pay before the account is overdue? a-2. If you take the full period, how much should you remit? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b-1. What is the discount being offered?

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter23: Other Topics In Working Capital Management

Section: Chapter Questions

Problem 8MC

Related questions

Concept explainers

Question

Transcribed Image Text:You place an order for 470 units of inventory at a unit price of $175. The supplier offers

terms of 2/15, net 90.

a-1. How long do you have to pay before the account is overdue?

a-2. If you take the full period, how much should you remit? (Do not round intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

b-1. What is the discount being offered?

b-2. How quickly must you pay to get the discount?

b-3. If you do take the discount, how much should you remit? (Do not round

intermediate calculations and round your answer to the nearest whole number,

e.g., 32.)

c-1. If you don't take the discount, how much interest are you paying implicitly? (Do not

round intermediate calculations and round your answer to the nearest whole

number, e.g., 32.)

c-2. How many days' credit are you receiving? (Do not round intermediate calculations

and round your answer to the nearest whole number, e.g., 32.)

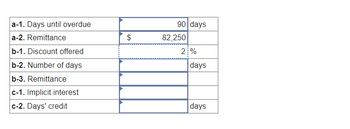

a-1. Days until overdue

a-2. Remittance

b-1. Discount offered

b-2. Number of days

b-3. Remittance

c-1. Implicit interest

c-2. Days' credit

days

%

days

days

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Transcribed Image Text:a-1. Days until overdue

a-2. Remittance

b-1. Discount offered

b-2. Number of days

b-3. Remittance

c-1. Implicit interest

c-2. Days' credit

$

90 days

82,250

2%

days

days

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning